Oposura

Core Assets

Battery Strategic Assets

Other Projects

Oposura Project (BRI 100%): Zinc-Lead-Silver

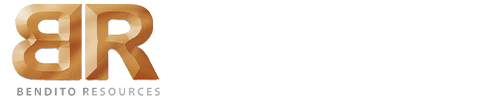

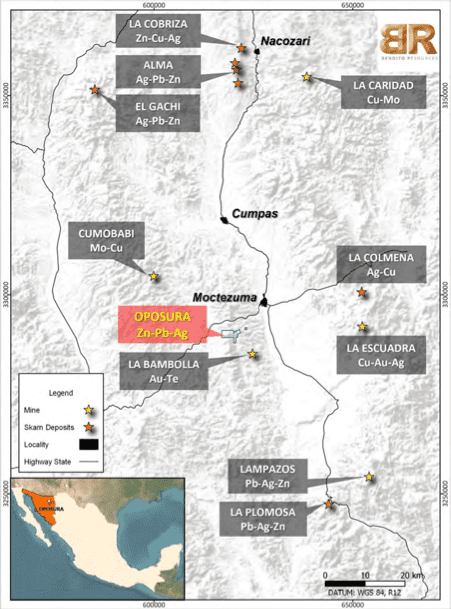

The Oposura Project is located 30 km southwest of the town of Moctezuma, Sonora, Mexico, and 150 km northeast of the Sonoran state capital of Hermosillo (Figure 1, same figure). The Oposura project consist of 12 mining concessions totaling 908 hectares and displays mineralization and alteration styles consistent with distal skarn Carbonate Replacement Deposits (CRD) – see Figure 2, same figure.

In January 2023, Bendito voluntarily filed a NI43-101 Technical Report for the Oposura Project discussing in detail the historical exploration works and provides context of the historical mineral resource estimates undertaken for Oposura East and West, as well as the exploration opportunities that Bendito is advancing to develop the property.

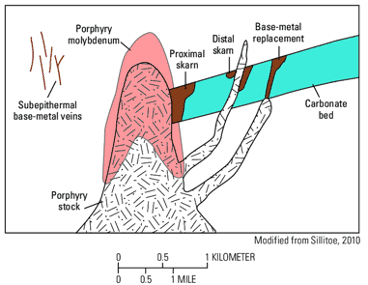

Near-term expansion of the historical resource estimates is largely defined by Oposura Central and the overall northern extension as shown in Figure 3, same figure. Oposura Central has been indicated by two widely spaced holes with the following drill intercepts (Figure 4, new figure):

OPDH-178: 9.5m @ 16.84% Zn, 4.19% Pb, 24 ppm Ag

Incl. 5.1m @ 22.6% Zn, 5.3% Pb, 34ppm Ag

OPDH-173: 12.05m @ 6.1% Zn, 1.7% Pb, 23ppm Ag

Incl. 4.1m @ 10% Zn, 1.94% Pb, 39ppm Ag

These holes demonstrate the connection between Oposura East, West, and Central and its sub-horizontal continuity along the 1.2km-long strike length. Mineralization remains open in all directions as indicated by the geophysical, geochemical, and mapping data, which defines the exploration criteria for the district.

The fully active production permit is allowing Bendito to perform open pit and underground mining activities, processing facilities, tailings disposal, and exploration works. A trial mining for direct shipping high-grade ore was performed in 2024 to understand mining parameters, metallurgy, commercialization exercise, and trigger the strategic partnership with Ocean Partners that assisted in acquiring a modular flotation plant with 500tpd capacity in second half of 2024, and develop a comprehensive mining plan that has been put together into a 43-101 compliant Preliminary Economic Assessment, leading Bendito’s efforts towards production in 2026; PEA’s summary is listed in the Table below:

Table 1. Summary of PEA Economics

Bendito Resources is now focused on three lines of value creation: immediate resource expansion in Oposura Central, strengthen economics of mining plan, and start operations in 2026 helping to transform Bendito into the next producer in Mexico.

NI43-101 Technical Report for the Oposura Project

Historical Mineral Resource Estimates

Historical estimates were performed for previous owners Azure for the Oposura East and Oposura West deposits. The historical estimates were supported by internal documentation, and prior to Bendito’s technical report on Oposura had not been disclosed in a technical report under NI 43-101. Table 1 provides historical estimates for Oposura. These are discussed in detail in Bendito’s technical report on Oposura in section “6.2 Historical Estimates”. Bendito plans to update the geological, structural, and alteration interpretations of these deposits in conjunction with exploration drilling to support new mineral resource estimates.

| Deposit | Indicated | Inferred | ||||||

| Tonnes (kt) | Zn (%) | Pb (%) | Ag (g/t) | Tonnes (kt) | Zn (%) | Pb (%) | Ag (g/t) | |

| Oposura East | 900 | 5.2 | 3.3 | 22.3 | 300 | 3.6 | 2.2 | 15.8 |

| Oposura West | 1,600 | 5.4 | 2.6 | 16.5 | 300 | 3.3 | 2.1 | 14.3 |

| Totals | 2,500 | 5.3 | 2.9 | 19 | 600 | 3.5 | 2.2 | 15 |

Notes:

• ZnEq US$: equivalent Zn% values in US$ are determined by the following factors, which have not been updated to allow Mineral Resources from Oposura East MRE update and the June 2018 West Zone MRE to be aggregated:

• Formula: ((Zn%/100*[Zn price US$]*[Zn concentrate recovery]*[Zn smelter recovery]) + (Pb%/100*[Pb price US$]*[Pb concentrate recovery]*[Pb smelter recovery]) + (Ag ppm*[Ag price US$]*[Ag concentrate recovery]*[Ag smelter recovery])) / (*[Zn price US$]/100*[Zn concentrate recovery]*[Zn smelter recovery])

• Assumed zinc commodity price = $3,107.5/t

• Assumed lead commodity price = $2,411/t (spot price, LME, 2018. www.lme.com, cited 0:00 GMT 20/06/2018)

• Silver $16.20/oz (spot price, NYSE, 2018. www.kitco.com, cited 0:00 GMT 20/06/2018)

• Assumed concentrate recoveries: Zn 87.5%, Pb 85%, Ag 67% (Locked Cycle Flotation tests: Azure Minerals Limited, 2018)

• Assumed smelter recoveries: Zn 85%, Pb 95%, Ag 70% (Benchmark Tests: BPDT & Co., 2018).

• It is the opinion of Azure Minerals Ltd that all the elements included in the calculation have a reasonable potential to be recovered and sold.

• Rounding may have caused imprecise total calculations.

Figure 1: Location of the Oposura Project 30km southwest of Moctezuma. Mines shown on the figure are operated by third parties.

Figure 2: Styles of mineralization within a schematic Carbonate Replacement Deposit (Figure from Taylor et al., 2010)

Figure 3: Oposura exploration and resource drilling areas

FIGURE 4. CROSS SECTION SHOWING OPOSURA CENTRAS AS THE IMMEDIATE RESOURCE EXPANSION ZONE.